To use a scanner for insurance claim processing, we first choose a flatbed or high-speed sheet-fed model based on our volume needs. We guarantee it has at least 300 dpi for clear document reproduction. Next, we implement Optical Character Recognition (OCR) to convert documents into machine-readable data, streamlining information extraction. By integrating automation technologies, we can speed up processing while improving accuracy and compliance. If you’re curious about enhancing your workflow even further, there’s more to explore.

Key Takeaways

- Choose a scanner that meets your needs, such as a flatbed for size versatility or a high-speed sheet-fed model for efficiency.

- Ensure the scanner has an optical resolution of at least 300 dpi for clear document reproductions during the claim process.

- Implement Optical Character Recognition (OCR) to convert scanned claims and invoices into machine-readable data for faster processing.

- Automate data capture and claim validations using technology to reduce manual errors and improve processing accuracy.

- Maintain data security by using encryption and conducting regular risk assessments to comply with industry regulations like HIPAA.

Selecting the Right Scanner for Your Needs

When selecting the right scanner for our insurance claim needs, we should consider a few key factors. It’s crucial to look at scanner features that match our specific requirements. Flatbed scanners offer versatility for various document sizes, while high-speed sheet-fed models are great for processing large volumes efficiently. User reviews often highlight the importance of optical resolution, so we should confirm it’s at least 300 dpi for clear reproductions. Additionally, connectivity options like USB and Wi-Fi will ease integration with our existing systems. We should also evaluate scanners’ capabilities in handling diverse document types, such as handwritten notes or multipart forms. Ultimately, the right choice will streamline our workflow and enhance our claims processing efficiency. Selecting a scanner with duplex scanning features can significantly reduce the time spent on processing double-sided documents.

Implementing Optical Character Recognition (OCR)

Implementing Optical Character Recognition (OCR) can drastically enhance our insurance claims processing capabilities. OCR technology converts scanned documents into machine-readable data, allowing for fast data extraction from claim forms, medical records, and invoices. This automation reduces manual entry time and minimizes errors, speeding up the overall claims process. Additionally, OCR enables us to capture valuable information like claimant details and policy numbers while transforming unstructured text into structured, searchable formats. By integrating OCR with claims management systems, we can guarantee real-time updates and improved operational efficiency. The result? Quicker validations and approvals, ultimately benefiting both us and our clients with a more streamlined experience in claims processing. Furthermore, utilizing high optical resolutions can significantly improve the accuracy of text recognition, ensuring that critical data is captured correctly.

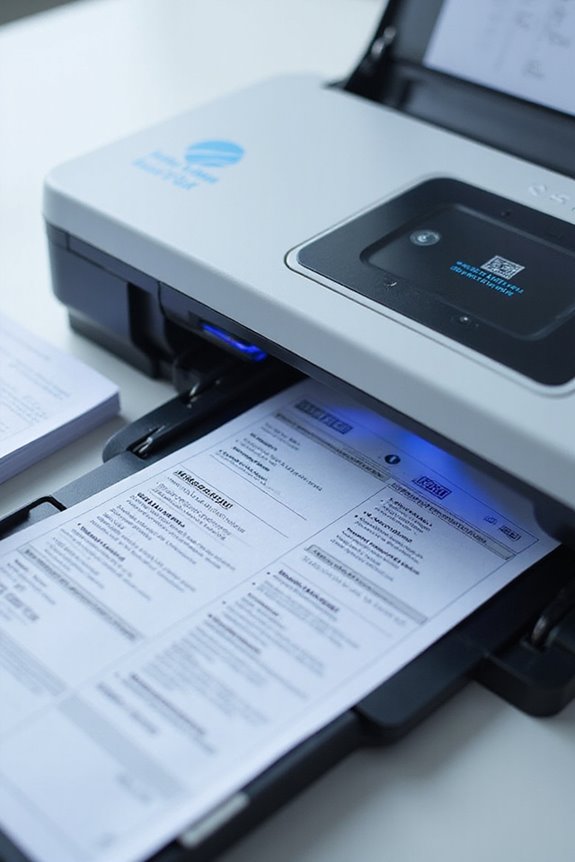

Enhancing Workflow With Automation Technologies

To enhance our workflow, we can leverage automation technologies that streamline the entire claims process from start to finish. These innovations enable workflow optimization by automatically consolidating claims from multiple sources, such as emails and customer portals. With real-time intake of multimedia data, we can initiate damage assessments immediately. AI algorithms validate claims against policy terms, ensuring eligibility while detecting potential fraud. Custom rules allow for automated claim decisions, minimizing delays. Through automated communication, we keep our customers informed, reducing uncertainty about their claims. RPA handles repetitive tasks, accelerating processing times considerably. Overall, implementing these automation benefits not only boosts efficiency but also enhances our ability to provide quicker, more accurate service to policyholders. Additionally, integrating a document management scanner can further improve the efficiency of processing claims by digitizing and organizing documents for easy retrieval.

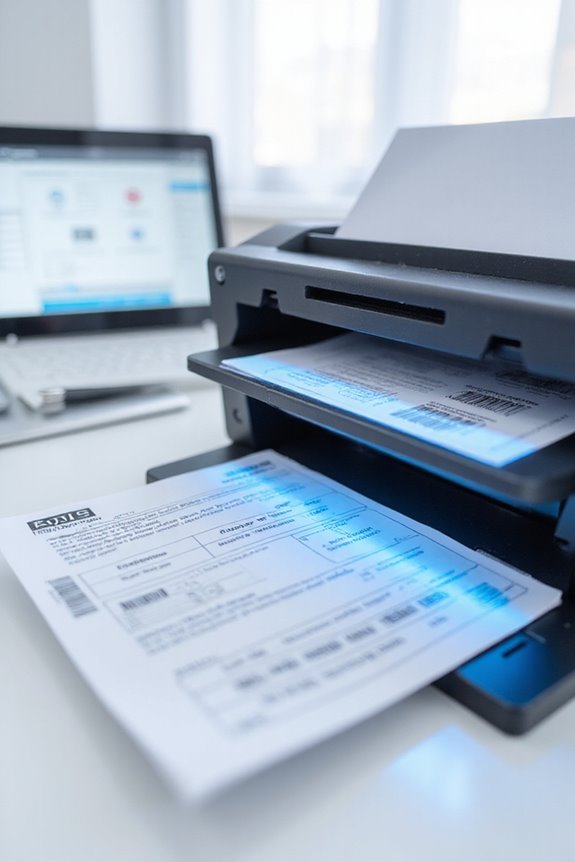

Improving Accuracy and Reducing Errors

Improving accuracy and reducing errors in the insurance claims process is essential for maintaining efficiency and customer satisfaction. By leveraging intelligent scanning solutions, we can enhance data integrity and greatly minimize human error. Automated data capture guarantees accurate claim processing, with AI achieving up to 99.9% accuracy. Real-time error tracking flags discrepancies early, preventing incorrect claim amounts that lead to denials or costly rework. Standardized assessment protocols reduce variability in evaluations, enhancing consistency and minimizing disputes. Additionally, integrating high-quality scanners with OCR technology guarantees legibility during digitization. These strategies not only streamline workflows but also boost productivity, with insurers reporting increases of 20-30% in efficiency. Ultimately, focusing on accuracy enhances our overall service, leading to happier customers. Furthermore, the integration of cloud storage with scanners facilitates instant saving and access to documents, further improving document management in the claims processing workflow.

Ensuring Security and Compliance

While guaranteeing security and compliance in the insurance claims process might seem challenging, it’s essential for protecting sensitive information and maintaining trust. We must prioritize data protection by implementing encryption methods like AES-256, guaranteeing that data remains secure during transmission and storage. Additionally, establishing clear compliance measures means familiarizing ourselves with laws such as HIPAA and TCPA while developing robust policies. Regular risk assessments help identify vulnerabilities and guarantee we’re compliant. We also should invest in training programs to keep our staff informed about compliance obligations. Implementing strict access controls and using Data Loss Prevention tools will help monitor data flows, safeguarding customer information while fostering a secure environment for the claims processing journey. Furthermore, selecting HIPAA-compliant scanners that ensure the protection of electronic protected health information (ePHI) is crucial for maintaining data security.

Achieving Efficiency Gains in Claims Processing

Efficiency gains in claims processing can revolutionize how we handle insurance claims, making the entire experience smoother for everyone involved. By implementing claims optimization strategies, we can reduce the turnaround time from weeks to days, greatly improving customer satisfaction. Our use of automation and AI not only streamlines workflows but also enhances accuracy and fraud detection. We’ve seen operational cost savings by reallocating resources onto high-value tasks, which further drives process improvement. These efficiency gains allow us to handle larger claim volumes without sacrificing quality. Additionally, standardized workflows and centralized data management create transparency, leading to quicker access and sharing of crucial information. Ultimately, we’re setting a new standard in claims processing that benefits our team and our policyholders alike. Furthermore, investing in high-speed duplex scanning technology can significantly accelerate the document management process within claims workflows.

Frequently Asked Questions

What Types of Documents Can Be Scanned for Claims Processing?

Imagine the whirlwind of emotions during claims processing. We can scan claim forms, medical records, and police reports, capturing every essential detail. Each document brings us closer to restoring peace for those in need.

How Do I Maintain My Scanner for Optimal Performance?

To guarantee our scanner maintenance promotes performance optimization, we should clean the glass regularly, update software, calibrate effectively, and inspect components often, keeping everything dust-free and functioning smoothly for the best results.

What Are the Best Practices for Training Staff on Scanning Processes?

When training staff on scanning processes, we should focus on promoting scanning accuracy and fostering staff engagement. Engaging our team guarantees they grasp best practices and understand the importance of their role in efficient document handling.

Can I Integrate Multiple Scanners Into One Claims Processing System?

Absolutely, we can integrate multiple scanners into our claims system. Ensuring scanner compatibility is key for smooth integration, allowing us to process claims more efficiently and manage documents from various scanners without issues.

What Backup Solutions Should Be in Place for Scanned Documents?

Did you know that 60% of businesses experiencing data loss never recover? We need robust cloud storage solutions with superior document security for our scanned documents, enabling easy access and protection against potential data breaches and loss.